UK Mortgage Rates Edge Down as Lenders Compete for Buyers

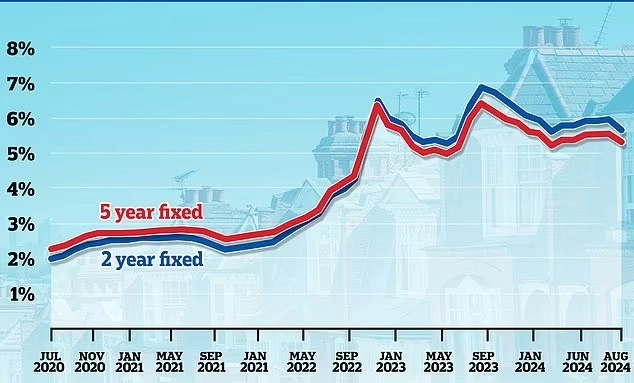

Mortgage rates in the UK have begun to edge down as major lenders compete more aggressively for customers, offering modest relief to homebuyers and homeowners after more than two years of elevated borrowing costs.

Several high-street banks and building societies have announced small reductions to fixed-rate mortgage deals in recent days, particularly on popular two- and five-year products. While the cuts are limited, analysts say they signal growing confidence that interest rates may be nearing their peak.

Industry experts say lenders are responding to a slowdown in the housing market. Transaction levels remain below long-term averages, and competition for a smaller pool of buyers has intensified. “Banks want to protect market share,” one mortgage broker said. “Cutting rates, even slightly, can make a real difference in attracting customers who have been sitting on the fence.”

Property data suggests demand has cooled as households remain cautious amid broader economic uncertainty. Rising living costs and concerns about job security have made buyers more reluctant to take on large financial commitments, despite signs that inflation is easing.

A spokesperson for one major lender said the recent changes reflected both market competition and improving stability. “We are seeing increased confidence as inflation comes down and expectations around interest rates become clearer,” they said. “That allows lenders to offer more competitive deals.”

Consumer groups are urging borrowers to shop around and seek independent advice, warning that loyalty to a single bank could prove costly. Even small differences in interest rates can add up to thousands of pounds over the lifetime of a mortgage, particularly for larger loans.

People who make decisions keep saying that it's important to find a balance between controlling inflation and promoting growth. The Bank of England has also said that it will only change its base rate if new economic data comes in. The markets are keeping a close eye out for any signs that rates might drop.

While the housing market remains subdued, analysts say the gradual easing in mortgage rates could mark the early stages of a turning point. For buyers who have been waiting for conditions to improve, the latest moves offer cautious optimism — though few expect a rapid return to the ultra-low rates of the past.

As one broker put it: “This isn’t a reset, but it may be the beginning of a slow shift in the right direction.”

Business